HOME GLOBALIZATION FILMS

| RESOURCES FOR THE INQUIRING MIND

HOME GLOBALIZATION FILMS |

|

HOME About Contact TOOLS Research Tools GLOBALIZATION Globalization Home Resources/Links Economics Books Courses G101 Description Start G102 Description Start Sample Modules from G101 & G102 Definitions Unequal Expansion Comparative Advantage GDP: Calculation IMF Disappearing Borders Global Consciousness MINI COURSES About Mini Courses Outsourcing 101 The Complicity Problem Taxes 101 Income Tax Brackets Effective Tax Rates Game: Your REAL taxes Global Warming 101 Gore vs. Skeptics Business Ethics 101 Basic Business Ethics Critical Thinking 101 Intro to Critical Thinking FILMS Films Home Film Books The Magic Mountain Film Theory Links Film Info Links Aristotle's Six Elements Visual Narrative: Ran Recommended Films Seven Mistakes of Film Criticism What Works and What Doesn't Miscellaneous Reviews Random Comments Lesser-Known Films Films and Communism Comics Help support this site by placing book or merchandise orders through us to Amazon. |

Structure and Policies of the IMFIn the context of the many debates about globalization, there is probably no more controversial institution than the IMF. For some, the IMF represents the epitome of international financial cooperation for mutual benefit; for others, to say "IMF" is to curse. In the Introduction to this course, you looked at the IMF website, so you already know the basic structure and purpose of the IMF. You already know that the IMF is a "club" of 184 nations that pool money for the purpose of preventing world financial crises of the type that developed prior to WWII (the Great Depression).  Number of Countries in IMF 1945-2003 Source: http://www.imf.org/external/about.htm In this module you will learn more about the fundamental structure and policies of the IMF. Most of the information here is directly from the IMF web site. We have reproduced here parts of some IMF responses to selected FAQs and IMF responses to common criticisms. The IMF is criticized from both sides of the political spectrum. We have indicated the kinds of criticisms in the diagram below. In this module, we will concentrate on how the IMF responds (or could respond) to common criticisms of its basic structure and basic policies.

For more on the critical views of the IMF, see our module on Stiglitz's Criticisms of the IMF. How Does The IMF Make Decisions? One of the issues in this course is what kind of representation we need to solve global problems. As you know, the global forces for democracy urge us in the direction of some kind of EQUAL representation for the nations and peoples of the world. The administrative structure and decision-making process of the IMF is complex. The Board of Governors (with representatives from every member state) meets only twice a year, but it is the highest authority in the IMF and makes all major policy decisions. An Executive Board, with 24 representatives, carries on the day to day work of the IMF and meets several times per week. The method of representation and voting at the IMF remains controversial. Here is the IMF's own description of the process(http://www.imf.org/external/pubs/ft/exrp/what.htm#who): Unlike some international organizations that operate under a one-country-one-vote principle (such as the United Nations General Assembly), the IMF has a weighted voting system: the larger a country's quota in the IMF—determined broadly by its economic size—the more votes it has (see "Where Does the IMF Get its Money?" below). But the Board rarely makes decisions based on formal voting; rather, most decisions are based on consensus among its members and are supported unanimously. The fact that the IMF uses a consensus model of voting, at least some of the time, can be used as a response to critics who argue, starting from the fact that its official voting system is weighted, that the IMF is simply an arm of the major economic powers. The weighting of the votes, based on quotas, is indicated in the diagram below.

How Does the IMF Support Itself? What Are the Costs to Taxpayers of Member Countries? The following excerpt is from an address delivered by Stanley Fischer, First Deputy Managing Director of the IMF, in 1998. Note in particular the analogy to a credit union. Source: http://www.imf.org/external/np/speeches/1998/012298.htm ...Let me emphasize that the IMF is not a charitable institution, nor does it carry out its operations at taxpayers' expense. On the contrary, it operates much like a credit union. On joining the IMF, each member country subscribes a sum of money called its quota. Members normally pay 25 percent of their quota subscriptions out of their foreign reserves, the rest in their national currencies. The quota is like a deposit in the credit union, and the country continues to own it. The size of the quota determines the country's voting rights, and the United States, with over 18 percent of the shares, is the largest shareholder. Many key issues require an 85 percent majority, so that the United States effectively has a veto over major Fund decisions. When a member borrows from the Fund, it exchanges a certain amount of its own national currency for the use of an equivalent amount of currency of a country in a strong external position. The borrowing country pays interest at a floating market rate on the amount it has borrowed, while the country whose currency is being used receives interest. Since the interest received from the IMF is broadly in line with market rates, the provision of financial resources to the Fund has involved little cost, if any, to creditor countries, including the United States.... We are deeply aware in the IMF that our support derives ultimately from the legislatures that vote to establish their countries' quotas--their deposits--in the IMF. We must justify that support. But it must also be recognized that contributions to the IMF are not fundamentally an expense to the taxpayer; rather, they are investments. They are an investment in the narrow sense that member countries earn interest on their deposits in the IMF. Far more important, they are also an investment in a broader sense, an investment in the stability and the prosperity of the world economy. In this same speech, Stanley Fischer also addressed the issue, sometimes raised by critics, that the IMF is "just provides bailouts" to failed governments and failed economic systems. These critics (generally on the right of the political spectrum) essentially reject the basic purpose of the IMF on the grounds that laissez-faire capitalism does not allow for bailouts of any kind. It would be better, these critics contend, to let economies go through their own "natural" cycles, including disasters, so that governments will really learn the lesson of bad policies and ill-conceived economic ideas. Fischer responds that IMF operations have nothing in common with bailouts. The IMF addresses global concerns: the costs of doing nothing in cases of economic crises far outweigh the costs of loaning money to countries in need. Does the IMF "Dictate" How Countries Run Their Economies? Yes, although "dictate" probably has the wrong connotations. If you are bankrupt, or owe your own government back taxes, the way you spend your money is tightly controlled. You may be able to apply for a loan in these circumstances, but you cannot spend the money loaned to you to buy a new swimming pool. You must spend it on what the bank or government deems to be productive. In the U.S., for example, if you owe money for back taxes, the government will assess your needs for necessities such as food and rent and will take the rest of your paycheck before you can spend it on anything else. In other words, the U.S. government tries to correct your "balance of payments problem" for you. This is an intrusive and controlling policy. Many people object to it. But is it morally wrong for those who are owed money to take coercive steps (within reason), to get the money owed them back? The situation is somewhat different in the case of the IMF, but the fundamental dynamic is the same. One can object, as critics of the IMF often do, that there are issues of national sovereignty at stake -- just as individuals who owe back taxes might argue there are issues of personal sovereignty at stake when their paychecks are controlled. Critics of IMF policies argue it should not be the job of the IMF to tell countries in need how to allocate the money loaned to them. Some critics also complain that the IMF essentially preys on countries in need and then forces them to open their markets and make other concessions solely for the benefit of the more powerful members. You should be aware of these fundamental forms of criticism. How does the IMF respond to such criticisms? Here is how the IMF describes some of the key points in its lending policy (source: http://www.imf.org/external/pubs/ft/exrp/what.htm#highlights): The IMF is not an aid agency or a development bank. It lends to help its members tackle balance of payments problems and restore sustainable economic growth. ...Unlike the loans of development agencies, IMF funds are not provided to finance particular projects or activities. IMF lending is conditional on policies: the borrowing country must adopt policies that promise to correct its balance of payments problem. The conditionality associated with IMF lending helps to ensure that by borrowing from the IMF, a country does not just postpone hard choices and accumulate more debt, but is able to strengthen its economy and repay the loan. The country and the IMF must agree on the economic policy actions that are needed. ... During 2000–01 the IMF worked to streamline its conditionality—making it more sharply focused on macro economic and financial sector policies, less intrusive into countries' policy choices, more conducive to country ownership of policy programs, and thus more effective. Note (bold print in quote above) that the policy was reformed to address the issue of sovereignty. Also note that countries must agree to the terms of the loan, so there is no "dictating" of policies that are not agreed to in advance. What Are IMF "Reforms" or Policies? The IMF generally stresses market fundamentalism -- i.e., capitalist principles. But (presumably) it will formulate a policy that is correct for the circumstances of the particular country in need. Originally, the IMF was chartered primarily to correct trade imbalances, and this is still a major part of its work. It may suggest (or require), for example, that a nation's currency be devalued in order to stimulate exports. This, of course, will create a "hardship" for the residents of that country, since imports would then be more expensive. Other reforms may include types of deregulation for government-controlled industries, to encourage new entries into the market place. Here is a description of how the IMF understands "reforms": In general, structural reforms have been associated with the notion of increasing the role of market forces — including competition and price flexibility, and the term is often used interchangeably with deregulation — reducing the extent to which government regulations or ownership of productive capacity affect the decision making of private firms and households. This perception of structural reforms clearly reflects the broad global trend during the past two to three decades, when an important part of structural reforms has been the replacement of general, across-the-board restrictions on competition and entry by new firms with more targeted, less intrusive restrictions. ...It would, however, be misleading to equate structural reforms with the goal of abandoning regulation altogether. Fundamentally, structural reforms aim at adapting institutional frameworks and regulations for markets to work properly. As is well known, some markets are prone to market failure or inefficiencies, and government regulations, if appropriately designed to minimize risks of government failure, can prevent less than desirable market outcomes. This may at times lead to a tightening of regulation, as is currently the case with regulations governing corporate governance or some securities markets...

Do IMF policies work? Stiglitz claims (see our module on Stiglitz) that the IMF policies are often destructive. For example, he claims the IMF actually made the transition of the formerly communist countries to capitalism worse. In other cases, for example, Southeast Asia, Stiglitz claims these economies have prospered not because of IMF policies but in spite of them. The IMF, of course, has a different view. We shall not be concerned with a case by case analysis of the value of specific IMF policies. For our purposes, it is sufficient to know that the IMF defends its policies on the basis that

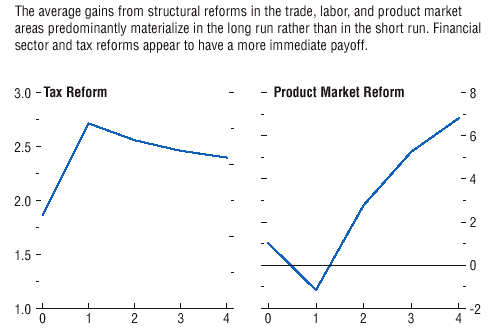

Here are sample graphs showing the general effect on GDP of "liberalizing" markets (i.e., applying some of the principles of market fundamentalism). See the IMF document Foserting Reforms in Industrial Countries, part of the IMF's annual publication, World Economic Outlook, for 2004. Note that this is based on an historical analysis of 20 industrialized countries from 1975 to 2000, so the analysis might not apply to developing countries. The horizontal scale is in 3 year increments. The vertical scale is percentage of GDP. The sectors that were "reformed" were the Tax code and a mix of industrial products/services (Gas, Electricity, Postal services, Telecommunications, Passenger air transport, Railways, and Road freight). Note that the product sector reforms had immediate effects that were negative, but this negative effect was followed by a turn-around after 3 years. Part of the IMF defense for its liberalizing policies is based on case studies like this one.

For the final exam in this course you should know what types of complaints are made against the IMF and how, based on the information in this module, the IMF might answer those complaints. Questions such as the following (or harder!) may be asked on the final.

Scroll down for answers. ANSWERS:

Additional Resources Academic paper on the weighted voting system: http://www.pubchoicesoc.org/papers/leech.pdf Left-wing, grass roots organization's complaints against the IMF: http://www.50years.org/about/ Created on ... May 01, 2004. Revised 10:06 6/17/2004 |